What Should You Look for in a Financial Advisor?

What Should You Look for in a Financial Advisor? If you’re serious about securing your financial future, you are likely considering the help of a financial advisor (or are already working with one). Without that critical relationship, it’s too easy to make mistakes or ignore a blind spot that can derail your plans. There’s simply too much at stake to go it alone. But here’s the key: it has to be the right financial […]

Continue reading ›

Financial Planning Opportunities to Prioritize When Changing Jobs

Financial Planning Opportunities to Prioritize When Changing Jobs They call it the Great Resignation. With more jobs available than Americans looking to fill them, recent months have presented a unique opportunity for those interested in finding something better. But along with a chance to upgrade your career, changing jobs can also present other financial opportunities. Because it is a busy time, it can be easy to miss those, which can mean a […]

Continue reading ›

Q2 2021 Passionate Investor

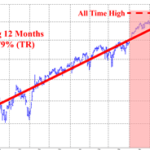

Q2 2021 Passionate Investor Market Review* Equity markets generally outperformed fixed-income markets with the S&P 500 rising 8.55% (including dividends; +15.25% YTD) and the Barclay’s Capital U.S. Aggregate Bond index rising 1.82% (-1.60% YTD). Small caps underperformed large-cap stocks (S&P 500) as the Russell 2000 small-cap stock index returned +5.47% (+17.54% YTD). Value outperformed growth […]

Continue reading ›Mutual Funds, ETFs or Stocks?

Are Mutual Funds Always a Better Choice Than Individual Stocks? Over the past few decades, mutual funds, along with their newer cousin, exchange-traded funds (“ETFs”), have ballooned in popularity. These financial tools provide convenience: you can diversify your investments in one fell swoop, so you are less subject to loss if any one company fails. Mutual funds can also help you buy an entire index or industry […]

Continue reading ›National Savings Day!

National Savings Day! Today is National Savings Day! It is important to make sure you’re maximizing your cash flow so that it works for you. Check out some helpful tips below for ways to help make saving a part of your lifestyle. Review your Cash Flow: Be strategic in the way that you build your […]

Continue reading ›Understanding the Differences between a Roth IRA and Traditional IRA

Understanding the Differences between a Roth IRA and Traditional IRA If you are considering a Roth IRA or Traditional IRA for retirement savings, it’s important to understand the differences and eligibility limitations for each. The biggest distinction between a Roth IRA and a traditional IRA is how and when you get a tax break. Contributions […]

Continue reading ›Quarantine-Friendly Activities for Kids this Summer

Quarantine-Friendly Activities for Kids this Summer Summer is going to be a bit different this year due to quarantine and the ongoing impact of Coronavirus. With the kids home even more than usual during the summer months you may be looking for some summer activities to keep them busy. Check out some quarantine-friendly activities that […]

Continue reading ›What to Do If You Have Been Laid Off or Furloughed

What to Do If You Have Been Laid Off or Furloughed COVID-19 has impacted the lives of millions of individuals beyond just their health but to how they provide for their families. The US Bureau of Labor Statistics stated that April unemployment rate spiked to the highest level since the Great Depression. With job security […]

Continue reading ›Meet Our Summer 2020 Interns!

Meet Our Summer 2020 Interns! Help Us Welcome Our Interns We’re excited to announce that we’ll have two interns working for us this summer. Luke will be working on Mondays and Tuesdays and Bailey will be working on Thursdays and Fridays. Bailey Schwab Education Bailey is a rising junior at Johns Hopkins University majoring in […]

Continue reading ›Ideas to Keep Children Busy During Quarantine

Ideas to Keep Children Busy During Quarantine Like many parents, you may be stuck at home with your children during a national emergency for an unknown amount of time. You can’t do your go-to activities such as go to the movies, play dates with friends, go out to eat, or visit their favorite park. So, […]

Continue reading ›