Understanding the Differences between a Roth IRA and Traditional IRA

Understanding the Differences between a Roth IRA and Traditional IRA

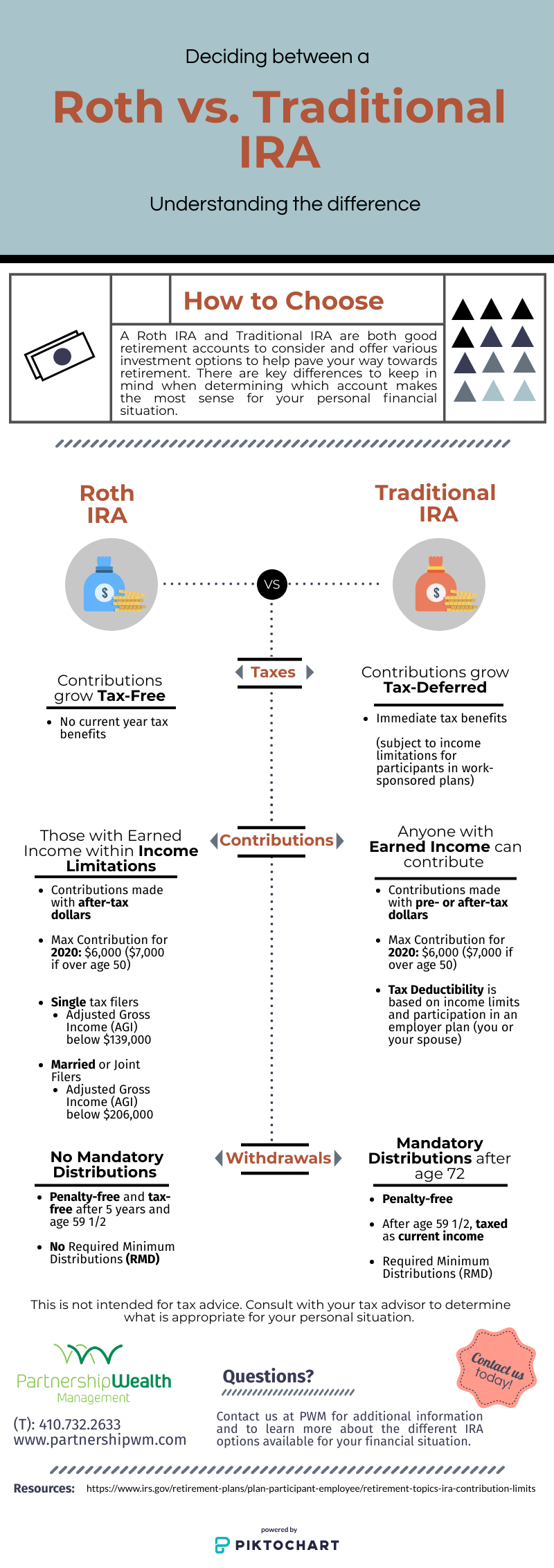

If you are considering a Roth IRA or Traditional IRA for retirement savings, it’s important to understand the differences and eligibility limitations for each. The biggest distinction between a Roth IRA and a traditional IRA is how and when you get a tax break. Contributions to traditional IRAs are tax-deductible, but withdrawals in retirement are taxable. In comparison, contributions to Roth IRAs are not tax-deductible, but the withdrawals in retirement are tax-free. Below are the other main differences between traditional and Roth IRAs.

In summary, with traditional IRAs, you deduct contributions now and pay taxes on withdrawals later; with Roth IRAs, you pay taxes on contributions now and get tax-free withdrawals later. Traditional IRAs function like personalized pensions: In return for considerable tax breaks, they restrict and dictate access to funds. Roth IRAs function more like regular investment accounts, only with tax benefits: They have fewer restrictions, but fewer breaks as well. Whether you think your annual income and tax bracket will be lower or higher in retirement is a key factor in determining which IRA to choose.

Questions and Consultations

If you have questions or if you’d like to schedule an appointment to discuss your finances, contact us today.

Want more information? Sign up to receive our monthly e-newsletter here.

Partnership Wealth Management is a comprehensive financial services company. We are committed to providing our clients with financial planning and wealth management services to help them make the most of their investments. At Partnership Wealth Management we have a long history of working with the LGBT community. Among our many services, we offer financial planning for gay couples and lesbian couples as well as estate planning for gay couples and lesbian couples. Financial planning is an important part of preparing for the future, contact us today to get started: www.partnershipwm.com.