The Passionate Investor Q4 2020

Market Review

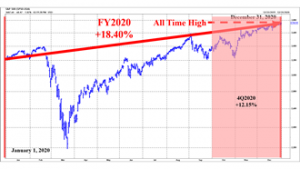

- Equity markets generally outperformed fixed-income markets with the S&P 500 rising 12.15% (including dividends; +18.40% YTD) and the Barclay’s Capital U.S. Aggregate Bond Index increasing 0.67% (+7.51% YTD).

- Small caps outperformed large-cap stocks (S&P 500) as the Russell 2000 small-cap stock index returned +31.37% (+19.86% YTD).

- Value outperformed Growth during the quarter but underperformed over the YTD period (as determined by the S&P 1500 broad market index which includes large, mid, and small-capitalization stocks).

- Non-U.S. equity markets outperformed U.S. markets in U.S. dollar (MSCI EAFE**: +16.09% and +8.28% YTD), but underperformed in local currency terms (+11.40% and +1.28% YTD, respectively).

- The MSCI Emerging Markets Index outperformed-U.S. developed (international) markets in both U.S. dollar (+19.77% and 18.69% YTD) and local currency terms (+16.09% and +19.50% YTD).

- All U.S. market sectors were positive. Energy (+27.77%; -33.68% YTD) and Financial (+23.22%; -1.69% YTD) stocks were most distinguishable given their strength and partial recovery from poor full-year performance.

- High yield bonds rose 7.66% during the quarter (+7.03% YTD). The U.S. corporate bond sector climbed 2.22% during the quarter (+10.06% YTD). 10-Year U.S. Treasury yields rose from 0.66% at the beginning of the quarter to 0.87% currently (+1.91% at the beginning of the year).

- The U.S. dollar fell versus the British Pound (-5.74%; -3.19% YTD), the Euro (-4.34%; -9.00% YTD), and Yen (-2.17%; -5.00% YTD).

* Unless otherwise noted, performances stated above reflect data provided by Standard and Poor’s, Russell Investments, MSCI, and Barclay’s Capital.

** The MSCI EAFE Index is a large capitalization, developed market benchmark that tracks non-U.S. or international equity markets.

Market Commentary

The S&P 500 climbed 12% during the quarter to its highest level ever, despite experiencing increased volatility and a pandemic-driven economic recession throughout the year. Additionally, investors shrugged-off a spring bear market as their worst fears of human and economic loss failed to materialize. One could sense the growing optimism in the year’s second half as investors’ mood changed from one of hope for a vaccine into one of certainty – despite growing levels of contraction, hospitalization, and mortality. Demand for stocks was also supported by a wave of new, perhaps speculative investors (Click HERE to read about this new class of investors) encouraged by cheap transaction costs, easy money (Click HERE to read about investors’ increased use of margin debt and inherently leveraged options trading), less supervision in a remote work setting, and billions of dollars in newly available stimulus funds.

The resulting “risk-on” environment allowed small-capitalization stocks (+31%) to outpace their large-cap cousins (the S&P 500), value stocks to rebound relative to growth stocks, and international stocks, both developed and emerging market stocks (+16% and +20% in USD, respectively) to outperform their domestic peers. Energy and Financial stocks, both among the worst-performing stocks over the full year, outperformed in the fourth quarter (+28% and +23%, respectively). Below investment grade (riskier) or high yield bonds (+8%) outperformed Barclay’s Capital U.S. Aggregate Bond index (+1%). Ten-year U.S. Treasury yields improved marginally while the U.S. dollar continued its slide versus most other major currencies.

The commentary presented herein contains the opinions of Partnership Wealth Management, a registered investment advisor. This information should not be relied upon for tax purposes and is based upon sources believed to be reliable. No guarantee is made to the completeness or accuracy of this information. Partnership Wealth Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes, and therefore are not an offer to buy or sell a security. Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. This information has not been tailored to suit any individual.

S&P 500 – 2020 Full Year and 4th Quarter Performance

Source: FactSet

Rip Van Winkled?

One could perhaps forgive Rip Van Winkle, the title character of American author Washington Irving’s famous short story of the same name (first published in 1819), if he concluded after waking up from a year-long hibernation (say between January 1, 2020 and December 31, 2020) that it was a typical year in stocks. Indeed, the S&P 500’s headline gain last year was remarkable not only based on the higher-than-average nominal return it recorded, but also because of the way it got there. There were enough pandemic-driven events that impacted the last year alone to easily make more than a few years seem busy. From an investing perspective, 2020 will be memorable for a number of reasons including a bear market in stocks that was quickly followed by a raging bull that sent stocks back collectively to all-time highs; a collapse in oil demand that caused the price of oil futures to briefly fall below zero dollars per barrel (in addition to strife between OPEC+ members); and a severe recession that is still with us today. We also observed historically high levels of monetary and fiscal stimulus that included a promise by the Federal Reserve to keep interest rates at ultra-low levels indefinitely; multiple stimulus checks struggling households; extended unemployment benefits for millions of dislocated workers; and bailouts for select industries, small businesses, and state and local governments. 2020 also included international events like Brexit and domestic ones like our own Presidential election. All of these headlines contributed to the elevated level of volatility that was present for most of the year (see chart below).

Investing involves risk including the potential loss of principle. No investment strategy can guarantee a profit or protection against loss in periods of declining value. Past performance does not guarantee future results. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

CBOE VIX Trailing 5-Year Performance Volatility Near Normalized Levels

Source: FactSet

What Worked in 2020?

We are not surprised to say that the three virtues that comprise our investment strategy were successful in 2020. The bear market made value stocks that sell at market prices below their intrinsic value attractive again. The extreme volatility that ensued allowed many of these stocks which were already selling at attractive prices prior to the correction, sell at an even greater discount during and after the phenomenon. The stellar rebound of some of the hardest-hit stocks was dismissed by some to be a lower quality or junk rally. However, it has been our experience that in moments of strong market dislocation, even the stocks of some of the most attractive or highest quality companies can be purchased at a tremendous value. A long-term time horizon is also critical to successful investing because it allows one to be patient. Patience allows the discerning investor the opportunity to exploit short-term market inefficiencies that may benefit them over the long term as things normalize. A long-term time horizon provides the patient investor valuable time to allow for their investments to potentially bear fruit.

What Didn’t?

Market timing is a two-step process that seeks to benefit from a stock market correction or bear market. The first step involves liquidating one’s investment portfolio in anticipation of a market decline. The second step involves re-investing the proceeds from step one back into the market once a bottom has been reached. The problem with this scheme involves the timing of both steps. Getting the timing right in both steps requires speculation (guesses), incredible foresight, and/or a lot of luck. Most practitioners of this scheme fail because they do not “time” the market well and incur transaction costs (including taxes), a real and permanent loss of capital, and/or severe opportunity costs along the way. Many fail to implement both steps successfully; usually getting one or both steps wrong. Some fail in terms of precision (not timing the sell and buy transactions perfectly), and still incurring the aforementioned costs.

The short duration of last year’s bear market complicates market timing schemes further as it requires even more precision. It took roughly a month for the S&P500 to descend from its all-time high on February 19, 2020, to its bear market trough on March 23, 2020; falling 34% along the way. It took the index roughly five more months for it to return to its prior high in February; soaring 70% off its low. This six-month period is significantly shorter than the typical bear market which lasts an average of 14 months. The S&P 500 returned 13% from its pre-bear market peak through the end of 2020, a stellar stock market return for ten months, let alone a full year. The point is, if one is a long-term investor or has a long-term time horizon, and just stayed put and did nothing, one could have ridden out the bear market and been fine (pocketing 13% along the way and avoiding unnecessary risk and costs) as the stock market rebounded. The stock market has had a natural bias or inclination to trend up, positively, historically, and over the long-term. We believe that market timing for most people last year (in any year really) may likely have involved experiencing a real and permanent loss of capital in addition to considerable opportunity costs.

Closing Remarks

I’m sure I’m not the only one who is glad for 2020 to be in the rear-view mirror. Although things were good for me on a personal note, and we were able to successfully implement our investment strategy for our clients, I know and understand that there are still a lot of people out there who have been and still are enormously impacted by the pandemic. We are still muddling through this crisis and nothing is for certain. Despite this, I can honestly say that I am very optimistic regarding our future. Those of you who know me personally will understand that I’m generally an optimistic, happy-go-lucky person to begin with. Still, I can honestly say that I can envision us turning the corner in the relatively near future (how is that for being vague?). With regards to the market/economy, despite all-time highs in stocks and continued economic murkiness, I believe that there are still opportunities out there to be discovered.

On a human level, I am hopeful that as more people get vaccinated, newer/better drugs come to market, and herd immunity finally sets in, statistics on contraction, hospitalization, and mortality will become more favorable. Our animal spirits will once again get the better of us and we will begin to socialize – normally, and not with six feet between us – as it was meant to be. I can envision a time when I can enjoy the company of old friends again, play music with the band, or feel the warmth of a family member I’ve not hugged in a long time. Dare I say that I am excited for 2021 and am looking forward to what it has in store for us? I’m hoping this optimism foreshadows the future and rubs off a little on you too. Please let me know if you ever need help or if you have any questions. Best wishes to you all in this new year and beyond.

I hope you enjoyed this quarter’s newsletter.

Stay safe and healthy,

Tim Hai, CFA®, CAIA®

Chief Investment Officer & Senior Portfolio Manager

Want to learn more about our Chief Investment Officer? Check out Tim’s Bio!

“An optimist sees an opportunity in every calamity; a pessimist sees a calamity in every opportunity.” — Winston Churchill

Questions and Consultations

If you have questions or if you’d like to schedule an appointment to discuss your finances, contact us today.

Want more information? Sign up to receive our monthly e-newsletter here.

Partnership Wealth Management is a comprehensive financial services company. We are committed to providing our clients with financial planning and wealth management services to help them make the most of their investments. At Partnership Wealth Management we have a long history of working with the LGBT community. Among our many services, we offer financial planning for gay couples and lesbian couples as well as estate planning for gay couples and lesbian couples. Financial planning is an important part of preparing for the future, contact us today to get started: www.partnershipwm.com.