Q2 2021 Passionate Investor

Q2 2021 Passionate Investor

Market Review*

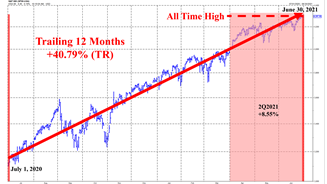

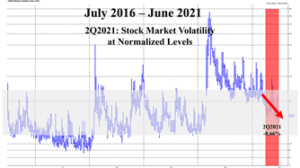

- Equity markets generally outperformed fixed-income markets with the S&P 500 rising 8.55% (including dividends; +15.25% YTD) and the Barclay’s Capital U.S. Aggregate Bond index rising 1.82% (-1.60% YTD).

- Small caps underperformed large-cap stocks (S&P 500) as the Russell 2000 small-cap stock index returned +5.47% (+17.54% YTD).

- Value outperformed growth during the quarter (as determined by the S&P 1500 broad market index which includes large, mid, and small-capitalization stocks).

- International or developed, non-U.S. equity markets underperformedS. markets in both U.S. dollar (MSCI EAFE**: +5.03%; +9.17% YTD) and local currency terms (+4.47%; +13.11% YTD).

- The MSCI Emerging Markets Index underperformed developed, non-U.S. equity markets (international) in both U.S. dollar (+4.88%; +7.58% YTD) and local currency terms (+3.42%; +8.08% YTD).

- All U.S. market sectors were positive during the quarter. Information technology (+13.23%; +13.76% YTD), telecommunication services (+11.16%; +19.67% YTD), and energy (+10.27%; +45.64% YTD) stocks were most distinguishable given their strength.

- High yield bonds rose 3.30% (+2.08% YTD) during the quarter. The U.S. corporate bond sector climbed 3.36% during the quarter (-1.94% YTD). 10-Year U.S. Treasury yields fell from 1.68% at the beginning of the quarter (0.87% at the beginning of the year) to 1.40% currently.

- The U.S. dollar rose versus the Japanese Yen (+0.62%; +7.50% YTD) but fell relative to the Euro (-1.12%; +3.08% YTD) and British Pound (-0.75%; -1.06% YTD).

* Unless otherwise noted, performances stated above reflect data provided by Standard and Poor’s, Russell Investments, MSCI, and Barclay’s Capital.

** The MSCI EAFE Index is a large capitalization, developed market benchmark that tracks non-U.S. or international equity markets.

Market Commentary

S&P 500 – Trailing 12 Months and 1st Quarter Performance

Source: FactSet

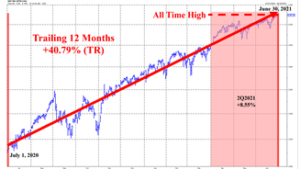

Inflationary concerns carried over into the second quarter as prices climbed along with expectations for economic growth. Rival camps argued over whether recent data pointed to inflation that is more transitory and fleeting (stemming specifically from last year’s pandemic) versus those who believe it is more secular and a longer-term problem for the nation. The ultimate fear from the “inflation is here to stay” camp is that the Federal Reserve will abandon or at least curtail its near-zero interest rate policy. Any change by the Fed, whether through talk or action, could upset investors and foreshadow heightened stock market volatility. Thus far, those in the opposing camp who believe that current inflation levels are transitory have successfully parried the former’s thrusts. The tug-of-war can be observed through the swings in the CBOE VIX (see below).

CBOE VIX Trailing 5-Year Performance Volatility Near Normalized Levels

Source: FactSet

Inflationary Concern?

The specter of inflation has captivated equity markets for the better part of the year and several clients and friends have asked us about our thoughts and approach to rising prices. Economists typically view inflation through two lenses, commonly referred to as “headline” and “core”. Headline inflation is comprehensive in the prices of goods and services it measures. Notably, it includes food and energy costs which can be periodically volatile and anomalous. Core inflation looks past the anomalies in food and energy pricing and is considered by economists to be a more reliable gauge of inflation.

Core (and headline) inflation measures have increased recently at a pace and level that is higher than expected. This has led some investors to believe that a change in Federal Reserve policy is at hand (i.e., higher interest rates). Economists have been particularly concerned with a low supply of labor in certain sectors of the economy that have led to increased wages. Wage inflation can be problematic because it is hard to relax and can compound existing inflationary pressure.

As alluded to in our commentary above, there are two opposing camps currently engaged together in a battle to control the inflation narrative. The first camp believes that bottlenecks in manufacturing and distribution related to last year’s pandemic have created supply/demand inequities that have driven prices up. They believe these imbalances to be short-term in nature and will self-correct in short order, as supply catches up with demand. The opposing camp believes that inflation is here and may remain a problem for years to come. They point to the labor shortages and related wage inflation we are currently experiencing and suggest that inflation is here to stay.

The Implication Being…

Inflation erodes the purchasing power of consumers and influences their shopping behavior. Consumers who anticipate inflation will stock up on their goods now, exacerbating current inflationary pressures and worsening supply/demand imbalances. Inflation in this way is said to be a self-fulfilling prophecy. If the pessimistic crowd is correct, then-Federal Reserve policy will more than likely change to reflect rising inflation. Interest rates will be lifted and other tools (i.e., asset purchases) that have helped to keep interest rates low will have to be suspended or reversed. How the Fed telegraphs its motives and intent is important. It is important to understand that well-choreographed and expected changes to the policy may still impact the stock market (i.e., increased volatility). However, unexpected policy changes that surprise everyone will have even stronger implications for stocks. Poor execution by the Federal Reserve has the potential to contribute to significant volatility and increase stock market inefficiency.

Our Familiar Approach

It is unclear as to how long inflationary pressures will last or how stocks will perform over that time. However, there is usually a good deal of volatility involved as information is disseminated unevenly. Volatility can also result from monetary policy failures related to strategy or implementation. Our investment strategy is agnostic as to the specific cause of volatility and views it as a symptom of market inefficiency. Thus, our long-term investment strategy reacts to volatility and not specifically to inflation. It seeks to take advantage of short-term stock market inefficiencies regardless of its root cause(s).

We do not make tactical changes to our portfolios in anticipation of changes to economic policy, inflationary pressure, or any macroeconomic events. We believe this would be akin to market timing. We do not like to make binary “bets” that entail a low probability of success. Regardless of the cause, we will wait for the volatility to appear before implementing changes to our portfolio. We only make changes in our portfolios based on changes in company fundamentals and valuation and only if we believe they will meet or exceed our expectations. And although our strategy is inherently reactive, we believe it is better than an approach that leaves a lot left to chance.

The commentary presented herein contains the opinions of Partnership Wealth Management, a registered investment advisor. This information should not be relied upon for tax purposes and is based upon sources believed to be reliable. No guarantee is made to the completeness or accuracy of this information. Partnership Wealth Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses, or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes, and therefore are not an offer to buy or sell a security. Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. This information has not been tailored to suit any individual.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protection against loss in periods of declining value. Past performance does not guarantee future results. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Closing Remarks

Inflation is a normal component in an economic cycle and is not always a terrible thing as it can be indicative of a prosperous and well-functioning economy. A problem arises when inflation rises too high or too fast. It is not difficult to understand how an economy in pandemic lows can rise quickly from its trough and exhibit inflation. Fiscal policy and stimulus checks may have also compounded the matter. Market dislocations can occur as a result. However, it is also not too difficult to believe that low interest rates may have contributed to higher demand (and prices) for homes, cars, or anything you can purchase with a credit card. Time is usually helpful towards resolving supply/demand imbalances if they are only transitory as some suggest. Otherwise, a more active approach will be necessary.

The Paul Volcker Federal Reserve is largely credited with winning the fight against inflation in the 1970s by raising interest rates to double-digit levels. Let us hope that today’s inflation issues will not become so problematic to need such draconian measures. Measured increases to interest rates may be required but not so much that the cure kills the patient. Despite our role in the matter, we do not hope to reach a high inflation environment. Rest assured however that if events prove for the worse, we will be opportunistic and make the best out of an imperfect situation. Having a long-term investment strategy in place that can potentially help you benefit from short-term stock market inefficiencies is important. This is how we fit in and can help. Please let us know if you have any questions. We wish everyone a wonderful and temperate summer.

I hope you enjoyed this quarter’s newsletter.

Stay safe and healthy,

Tim Hai, CFA®, CAIA®

Chief Investment Officer & Senior Portfolio Manager

Want to learn more about our Chief Investment Officer? Check out Tim’s Bio!

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output” — Milton Friedman

Questions and Consultations

If you have questions or if you’d like to schedule an appointment to discuss your finances, contact us today.

Want more information? Sign up to receive our monthly e-newsletter here.

Partnership Wealth Management is a comprehensive financial services company. We are committed to providing our clients with financial planning and wealth management services to help them make the most of their investments. At Partnership Wealth Management we have a long history of working with the LGBT community. Among our many services, we offer financial planning for gay couples and lesbian couples as well as estate planning for gay couples and lesbian couples. Financial planning is an important part of preparing for the future, contact us today to get started: www.partnershipwm.com.