Health Savings Account

About Health Savings Accounts

Have you ever considered the potential benefits of contributing to a Health Savings Account (HSA)? Here is your guide!

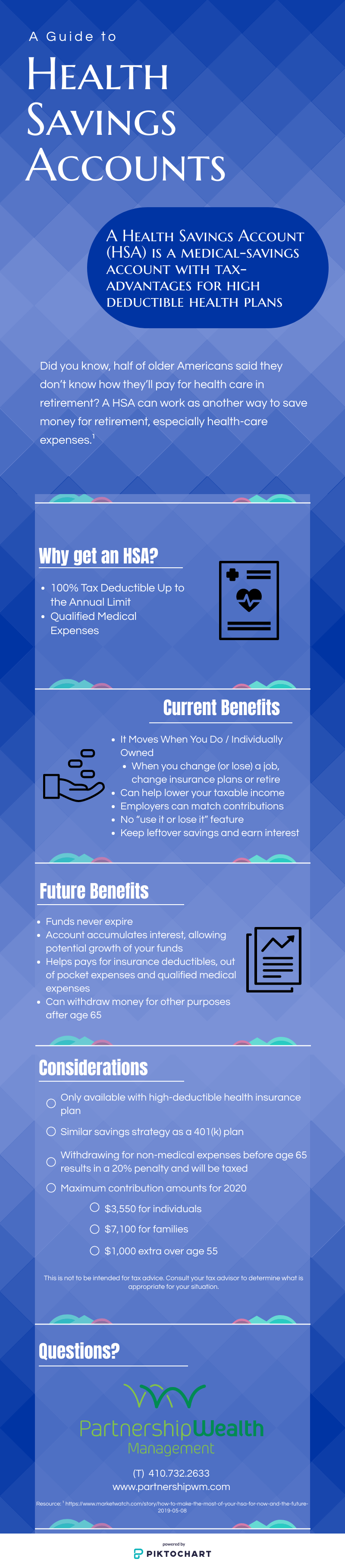

A Health savings account is medical savings account with tax advantages for high deductible health plans. Did you know half of older Americans said they don’t know how they will pay for health care retirement – especially health care expenses? A Health Savings Account (HSA) can help people with high-deductible health insurance plans cover their out-of-pocket costs. Contributions to HSAs aren’t subject to federal income tax, and the earnings in the account grow tax-free. Unspent money in an HSA rolls over at the end of the year, so it’s available for future health expenses. High-deductible health plans, which are a requirement for HSAs, aren’t always the best option, especially for those who expect to have significant healthcare expenses in the future.

In conclusion, the tax advantages of an HSA and the ability to roll over unspent money are definitely an upside. But, high-deductible health plans aren’t always everyone’s best option. Are unsure about what insurance plan is best for you? Contact us today to help.

Questions and Consultations

If you have questions or if you’d like to schedule an appointment to discuss your finances, contact us today.

Want more information? Sign up to receive our monthly e-newsletter here.

Partnership Wealth Management is a comprehensive financial services company. We are committed to providing our clients with financial planning and wealth management services to help them make the most of their investments. At Partnership Wealth Management we have a long history of working with the LGBT community. Among our many services, we offer financial planning for gay couples and lesbian couples as well as estate planning for gay couples and lesbian couples. Financial planning is an important part of preparing for the future, contact us today to get started: www.partnershipwm.com.