Q1 2021 Passionate Investor

Market Review

- Equity markets generally outperformed fixed-income markets with the S&P 500 rising 6.17% (including dividends) and the Barclay’s Capital U.S. Aggregate Bond index falling 3.37%.

- Small caps outperformed large-cap stocks (S&P 500) as the Russell 2000 small-cap stock index returned +12.70%.

- Value outperformed growth during the quarter (as determined by the S&P 1500 broad market index which includes large, mid, and small-capitalization stocks).

- International or developed, non-U.S. equity markets underperformed. markets in U.S. dollar (MSCI EAFE**: +3.60%) but outperformed in local currency terms (+7.72%).

- The MSCI Emerging Markets Index underperformed developed, non-U.S. equity markets (international) in both U.S. dollar (+2.34%) and local currency terms (+4.02%).

- All U.S. market sectors were positive during the quarter. Energy (+30.85%) and Financial (+15.99%) stocks were most distinguishable given their strength and recovery from last year’s poor performance.

- High yield bonds fell 0.95% during the quarter. The U.S. corporate bond sector fell 5.01% during the quarter. 10-Year U.S. Treasury yields rose from 0.87% at the beginning of the quarter (year) to 1.70% currently.

- The U.S. dollar fell versus the British Pound (-0.93%) but climbed relative to the Euro (+3.94%) and Yen (+7.03%).

* Unless otherwise noted, performances stated above reflect data provided by Standard and Poor’s, Russell Investments, MSCI, and Barclay’s Capital.

** The MSCI EAFE Index is a large capitalization, developed market benchmark that tracks non-U.S. or international equity markets.

Market Commentary

US stocks were again the envy of the world as most indices climbed near or above their all-time highs. The quarter was notable for a few moments of increased stock market volatility and disruption – each with its own distinct cause. Shares of so-called “meme” stocks like video game retailer GameStop recorded extreme spikes in share price and trading volume over a short period of time (in late January) and based on enthusiasm (not fundamental in nature) driven by social media excitement through online forums like Reddit. Interest rates in the US also increased sharply during the quarter (see below) based on rising optimism for economic growth after a year of COVID-19 related fatigue. The ensuing inflationary concerns jostled bonds and stocks alike as investors worried that the Federal Reserve would abandon its commitment to an ultra-low interest rate policy (which it refuted).

Small-capitalization stocks (+12.70%) continued to outpace their large-cap cousins (the S&P 500; +6.17%), while value stocks strengthened relative to growth stocks. Developed international stocks outperformed US stocks in local currency terms but trailed after adjusting for the strengthening US dollar (+7.72% and +3.60%, respectively). Emerging market stocks underperformed in both local currency and US dollar terms (+4.02% and +2.34%, respectively). Energy and Financial stocks, both among the worst-performing stocks last year, outperformed during the quarter (+30.85% and +15.99%, respectively). The Barclay’s Capital U.S. Aggregate Bond index fell 3.37% as bonds underperformed relative to stocks in a rising interest rate environment. Yields on 10-year U.S. Treasury bonds rose sharply from 0.87% at the beginning of the year to 1.70% currently. The U.S. dollar rose generally (particularly towards quarter-end) as investors pursued higher interest rates.

The commentary presented herein contains the opinions of Partnership Wealth Management, a registered investment advisor. This information should not be relied upon for tax purposes and is based upon sources believed to be reliable. No guarantee is made to the completeness or accuracy of this information. Partnership Wealth Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes, and therefore are not an offer to buy or sell a security. Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. This information has not been tailored to suit any individual.

S&P 500 – Trailing 12 Months and 1st Quarter Performance

Source: FactSet

Investment Philosophy

What an amazing 12-months we’ve had. A year ago, we were in what seemed like the early-to-middle innings of a stock bear market and we did not know the market had already begun staging a rally. We believe we were successful in implementing our strategy over this period but will leave it to our clients to be the ultimate judge of that. How did we do it? Recall our investment philosophy which adheres to the belief that the stock market is inherently inefficient, especially in the short-term, and is prone to volatility in stock prices (please click HERE for a more in-depth discussion of our investment philosophy and strategy or read the adjoining blue panels in this newsletter). We also do not believe that stock market volatility is the greatest risk to investors. This dubious honor belongs to the risk of a permanent loss of capital – the actual loss of money that one experiences when an investment is sold at a price below its cost. Finally, we believe excess diversification is detrimental to investors who seek long-term value add through active portfolio management.

Investing involves risk including the potential loss of principle. No investment strategy can guarantee a profit or protection against loss in periods of declining value. Past performance does not guarantee future results. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Value, Quality, and Long-Term

We were able to successfully navigate last year’s pandemic-driven storm by sticking to our investment strategy. Our strategy then and now is simple: exploit short-term stock market inefficiency and volatility by investing our clients’ monies in a concentrated portfolio of stocks with the goal of adding value over the long term. We afford ourselves breathing room by investing in value stocks that have a sufficient margin of safety or sell at a sufficient discount to intrinsic value. Further, we try to avoid or minimize a permanent loss of capital by investing in quality stocks we believe to be going concerns – stocks of companies that we believe will exist years from now because they are financially sound businesses and/or have durable competitive advantages that can protect their operations from the competition. Lastly, we allow our investments sufficient time to bear fruit by adhering to a long-term investment time horizon.

A Unique Period in Time

The stock market and much of the events that occurred over the past year were unique in part because we (most of us) had not lived through a crisis that was existential in nature in recent memory. Many of us were swimming in unchartered waters. Comparable moments in modern history include both world wars or more obviously the Spanish influenza of 1918 – all events having occurred over 75-years ago and were not experienced by most of us. Professional and amateur investors alike were understandably confused by the ordeal as it was dynamic. Bad advice was rampant during the period as information flow was uneven and very fluid in nature. Much of it was disseminated by politicians, investment talking heads, and medical professionals – people we typically look to for answers in difficult times. And so, expectations for the future were equally problematic as no one had a clear read over what was unfolding in real-time. Widespread panic ensued and irrational behavior by many stock market participants caused heightened levels of volatility.

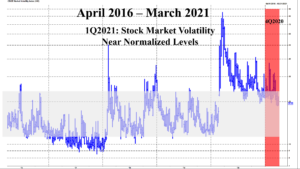

CBOE VIX Trailing 5-Year Performance Volatility Near Normalized Levels

Source: FactSet

Lessons Learned

We believe emotions are one of the main scourges of investing. It may sound cheeky to suggest but we believe it is true. Emotions in many instances drive otherwise rational investors to gamble away their nest egg in a market-timing scheme. Emotions and fear or greed particularly, compel investors to adjust their focus from the long-term, towards news that is more immediate and currently impacting the stock market. They allow themselves to be swayed by the chatter on television, or by the talking heads on CNBC. They become myopic and cannot see the forest for the trees. As we mentioned in our previous newsletter (click HERE), investors who attempted to time the market over the last year at best, (probably) failed to participate in much of the gains to be had over the period due to opportunity loss. At worst, they suffered a real and permanent loss of capital as they sold their holdings at lower prices as the sky seemed to be falling around them. Investors who were more disciplined, able to manage their emotions, and stuck to a prescribed, long-term investment strategy, probably came out of last year in better shape.

Closing Remarks

We believe that 2020 was a success for our clients who remained patient and continued with our long-term approach. We helped them to remain focused on our investment strategy. It helped that we kept a level head and our emotions in check. And we fulfilled our promise of being active investors, keen on adding value for our clients over the long term. We took advantage of opportunities to defend our existing positions or to introduce new ones to our portfolios. More importantly, we were able to minimize permanent losses of capital which we believe to be the biggest danger to investors. Would we do things differently in the face of differing circumstances? We can emphatically say “No”. We understand that we have a very important job as steward of our client’s wealth, and we understand that a long-term investment strategy (preferably ours) is the best way to help them reach their long-term investment goals. We wish everyone a prosperous and healthy spring. Please stay disciplined.

I hope you enjoyed this quarter’s newsletter.

Stay safe and healthy,

Tim Hai, CFA®, CAIA®

Chief Investment Officer & Senior Portfolio Manager

Want to learn more about our Chief Investment Officer? Check out Tim’s Bio!

“Your success in investing will depend in part on your character and guts and in part on your ability to realize, at the height of ebullience and the depth of repair alike, that this too, shall pass.” — Jack Bogle

Questions and Consultations

If you have questions or if you’d like to schedule an appointment to discuss your finances, contact us today.

Check out more information about our investment strategy and make sure to sign up to receive our monthly e-newsletter here.

The opinions voiced in this material are for informational purposes only and are not intended to provide specific advice to any individual. Consult your legal, tax, and/or financial advisor to determine what is appropriate for your situation.

As a Registered Investment Advisor (RIA), Partnership Wealth Management is committed to providing our clients with financial planning and wealth management services to help them work towards their financial goals. At Partnership Wealth Management, we have a long history of working with the LGBT community. Among the many services we offer are financial planning and estate planning strategies for gay and lesbian couples. Financial planning is an important part of preparing for the future; contact us today to get started: www.partnershipwm.com.