1st Quarter Recap

After the last two years, during which the S&P 500 saw solid and consistent returns, volatility came back beginning in mid-February. The unpredictability surrounding tariffs has created uncertainty for the markets and the future of our economy.

Tariffs- a partial timeline through March 31st

On the campaign trail, President Trump promised to tariff countries to, in part, level the playing field for companies that manufacture U.S. goods and help balance the budget. So, there was no surprise in seeing the rollout of tariffs. Still, the size and scope of the initial tariffs shocked the markets, and the implementation led to some confusion.

- On February 1st, President Trump enacted tariffs on Mexico, Canada, and China.

- Two days later, he announced a 30-day pause on tariffs with Canada and Mexico.

- The next day, China announced retaliatory tariffs against the U.S.

- On February 10th, new tariffs on steel and aluminum are announced and set to begin in mid-March. Over the next couple of weeks, further indications of additional tariffs being considered are announced.

- The 30-day pause on tariffs with Mexico and Canada expired on March 4th. Canada and Mexico immediately promised retaliatory tariffs.

- The following day, President Trump granted another month-long pause, but just on some goods from Canada and Mexico.

- A day later, he expanded the pause to additional imported items from Canada and Mexico.

- On March 12th, steel and aluminum tariffs began. The European Union (EU) was impacted by these tariffs and threatened with retaliatory tariffs. Canada announced retaliatory tariffs of its own. The following day, President Trump threatened the EU with tariffs on EU wine, liquor, and Champagne if the EU moves forward with its retaliation.

- On March 26th, President Trump announced 25% tariffs on all auto imports.

For the most part, the size and some of the targets of President Trump’s tariffs surprised the markets. Although most expected some level of tariffs, the aggressiveness with which he’s acted has seemed excessive and worrisome. One of the biggest fears is that the continuation of reciprocal tariffs will evolve into a full-blown trade war that could devastate economies across the globe- including ours.

We see a few possibilities with tariffs:

- Tariffs keep as is for an extended period

- We’ll likely see inflation increase and a possible recession on the horizon.

- The Fed might struggle with its dual mandate of taming inflation and maximum employment, possibly leaning towards supporting jobs over inflation.

- Interest rates could remain higher for longer.

- There’s an outside chance of stagflation- when inflation is rising, unemployment is high, and the economy is weakening- which is something everyone wants to avoid because of how bad it can be for the economy.

- There’s an escalation of tariffs, creating a trade war

- This could accelerate inflation, increase unemployment, and lead to negative economic growth.

- This is the last thing nearly everyone wants to see.

- Trade agreements are negotiated, and tariffs are pulled back, at least to some extent

- This could help to give the markets some confidence and a reason for a quick rebound.

- If done soon enough, this might help reduce the negative impacts of tariffs, including inflationary pressures.

If President Trump’s primary goals are to increase U.S. manufacturing and to offset his tax plans, tariffs will likely need to continue for some time. Building out the manufacturing base will take years, and for any potential benefits to the budget to be meaningful, they will need to occur over years. If he meets these goals, we will likely see option 1 or 2 occur.

If he’s using tariffs as leverage to get better trade deals and help with enforcing our borders, then we might have an opportunity to see option 3. Most economists and market watchers favor option 3 as it benefits the U.S. economy while impacting the global economy in a much smaller way.

Here’s a deeper dive into tariffs from T. Rowe Price.

Volatility is back

- From February 19th through the end of the quarter, the S&P was down 8.29% despite having several days with positive returns of over 1%, including a day when the S&P 500 was up by over 2%.

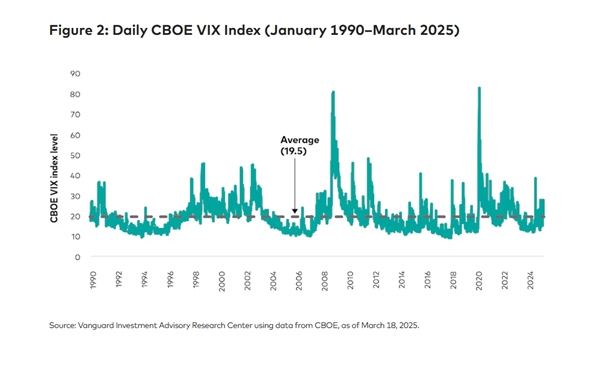

- Keep in mind that volatility is normal. According to Vanguard, the volatility we had through mid-March was average. As you can see in the chart below, the index that monitors market volatility (the CBOE VIX Index) has had an average daily value of 19.5 since January 1990. Although this past quarter’s volatility might have felt high, it’s not far off historical norms.

Lessons learned over a 26-year career

Markets hate uncertainty

Market analysts can’t price in expectations when there are too many unknowns. Bad news can throw cold water on the markets. Still, analysts and stock pickers can use their models to create valuations for companies under poor circumstances. When analysts don’t know what to expect, they cannot estimate the future impact of what’s happening. If there isn’t a way to value a company, many investors won’t buy stocks out of concern that they might be overpaying for their investment. Without buying, more people become sellers, and the markets drop.

When there’s uncertainty and the markets drop, people become fearful

People tend to invest with their emotions. When people see others making money, they naturally want to flock towards that investment. The issue is that by the time we get the itch to buy the hot opportunity, it’s likely too late. The same holds true during downturns. When the markets go down, we become fearful and want to sell to avoid further losses.

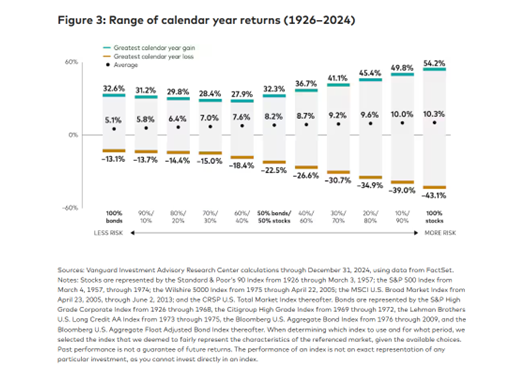

Although recent volatility might make you nervous and want to sell, it is important to remember to stay the course. The good news is that most of the biggest up days follow the worst periods. Unfortunately, we never know when the recovery will begin. Using history as a guide, we can see how an average year for the markets compares to the extremes.

Market timing rarely works

The biggest issue with market timing is that you must be right twice- when you decide to sell and when you decide to buy. Yes, sometimes people have correctly decided when to get out of the market, but typically, I’ve seen people get out of the market fearful of a downturn only to watch the stocks continue to climb or sell near a market’s bottom.

Even when someone gets out at the right time, they need to be comfortable buying back into the market at a lower point than when they got out. That’s difficult because most people want to feel good about the market/economy before reinvesting their money. Yet, it often takes a market recovery to instill that confidence. To make it all the more challenging, we sometimes see the market give us a quick jump up only to take another leg down. So, someone who waits to see a recovery might reinvest their money only to have the markets drop further. Also, as I previously mentioned, markets can snap back just as quickly as they initially retreated, catching investors off guard.

Our focus is on our clients’ time frames, not market timing. If you’re investing for a short-term goal (less than ten years), you may want to consider limiting your exposure to stocks. You don’t want to find your portfolio dramatically lower when you need to make a withdrawal.

Overall, our recommendation for clients is to stay the course. Ongoing wisdom is that time in the market beats trying to time the markets.

Market drops can provide opportunities

While many fear periods of market weakness, these can have significant benefits. In the words of famed investor Shelby Cullom Davis, “You make most of your money in a bear market; you just don’t realize it at the time.” During market declines, we can find bargains in the form of solid companies trading at discounts. Downturns are emotionally tough, but they often don’t last long. Although it’s not as fun at the time as going to the store and buying something on sale, buying into the markets during downturns can help long-term investment performance.

Here’s an article from CNBC examining past market downturns and their recoveries.

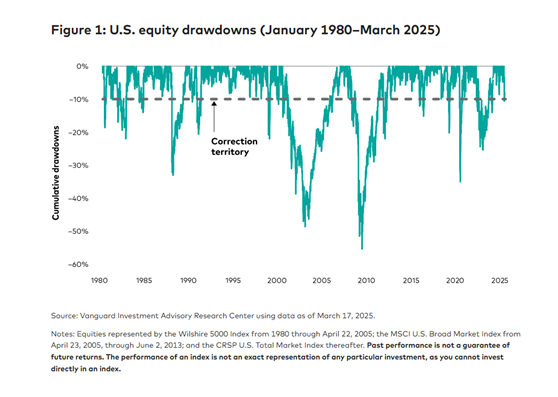

Although corrections (as defined by the markets declining by at least 10%) and bear markets (declines of at least 20%) have occurred with some regularity over the past 45 years, those were followed by strong recoveries.

Looking at it another way, within a year, each of the major market declines of the past 38 years has bounced back at least 21.4%.

Source: Morningstar. Returns are principal only, not including dividends. Stocks are represented by the S&P 500 Index, an unmanaged index that is generally considered representative of the U.S. stock market. Past performance is no guarantee of future results. For illustrative purposes only. It is not possible to invest directly in an index.

Dollar-cost averaging works best when the markets dip

For your long-term goals, keep adding to your investments at the same level you have been- or increase that amount to buy more shares of investments as they go down in value. Dollar-cost averaging can help you recover faster and add more value to your portfolio over time. This article from Fidelity explains how dollar-cost averaging works and the potential benefits during market declines.

Frequently expressed concerns during down markets

This time is different.

Yes, current conditions are different than those of the past, but that’s always been the case. Nothing is exactly the same as before, so we have used lessons derived from the market information over the past 100+ years. By staying focused on the long term, we can help tune out the noise during short-term volatility.

I’m retired (or about to), so I don’t have a long-term horizon.

Although you don’t have the same horizon you did when you were 40, you still could have a long-term horizon. Someone retiring at 65 might need income for the next twenty-plus years. Retirement isn’t like buying a refrigerator- you’re not paying for a lifetime of income on the day you retire. We work with clients to have an income plan providing them with at least three years’ worth of anticipated withdrawals in cash-like investments so they have the time to weather the ups and downs of the market. This income ladder increases as clients move through retirement to help provide older clients with a larger cushion. This buffered approach can go a long way in shielding you financially and, more importantly, emotionally when the markets get rocky.

Conclusion

The risk is that a global trade war and/or a recession could cause markets to drop further. However, we could also see a quick recovery if we’re able to quickly negotiate terms with other countries that the administration finds acceptable for backing off tariffs. Although we don’t know what the outcome will be, having a long-term view can help us stomach short-term volatility.

For those focused solely on the long term, this could be an opportunity to buy into equities at a discount. For those with short-term cash needs, having an appropriate buffer can help weather market pullbacks.

Regardless of short-term action, long-term investors should expect, not fear, downturns. Periodic weakness is a natural part of the process. We’d be more concerned if things went up in a straight line without some scary bumps. Just like a sprinter needs to stop for rest between spurts, short-term market declines are normal and healthy for the market.

Of course, we completely understand that uncertainty and market declines can leave clients fearful of the future. Know that we are always here for you. If you have questions about your portfolio or need to talk, please contact us- we’re here to help.

1st Quarter 2025 Returns1

S&P Total Return (TR) -4.27%

S&P 500/Citigroup Growth TR -8.47%

S&P 500 Value TR +.28%

S&P MidCap 400 TR -6.10%

S&P (SmallCap) 600 TR -8.93%

MSCI Developed EAFE (USD) +7.01%

MSCI EAFE Small/Mid Cap (USD) +5.15%

MSCI Emerging MKTS (USD) +2.41%

Bloomberg Agg Bond Index Composite +2.80%