How to Keep Your Cool During Financial Turmoil with Mindfulness and Other Strategies

How to Keep Your Cool During Financial Turmoil with Mindfulness and Other Strategies It’s common to find yourself feeling anxious during turbulent financial times. However, controlling these feelings is crucial to avoiding emotionally-driven financial mistakes. In this article, we’ll explore some simple strategies to navigate today’s volatile times with less stress. 1. Break the Habit of Constantly […]

Continue reading ›Q4 2022 Passionate Investor

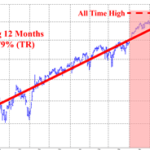

A recession on the horizon? Over the past few years, market chatter has rotated among concerns of inflation, rising interest rates, and a recession. Most of the talking heads see the worst of inflation behind us and anticipate a potential end to rising interest rates in the near future. The discussions have now begun to focus on […]

Continue reading ›College Transition Tips for Parents and Kids: How to Prepare for the Big Move

College Transition Tips for Parents and Kids: How to Prepare for the Big Move The time has come; your child is heading off to college! This can be a bittersweet event for you as a parent. If you feel a little lost, don’t worry, it is normal and expected. We have some tips for parents […]

Continue reading ›Q4 2021 Passionate Investor

Q4 2021 Market Review and Commentary Market Review* Equity markets generally outperformed fixed-income markets with the S&P 500 rising 11.03% (including dividends; +28.71% YTD) and the Barclay’s Capital U.S. Aggregate Bond index rising 0.01% (-1.54% YTD). Small caps underperformed large cap stocks (S&P 500) as the Russell 2000 small cap stock index returned +2.14% (+14.82% […]

Continue reading ›Q3 2021 Passionate Investor

Q3 2021 Market Review and Commentary Market Review* Equity markets generally outperformed fixed-income markets with the S&P 500 rising 0.58% (including dividends; +15.92% YTD) and the Barclay’s Capital U.S. Aggregate Bond index rising 0.05% (-1.55% YTD). Small caps underperformed large-cap stocks (S&P 500) as the Russell 2000 small-cap stock index returned -4.36% (+12.41% YTD). Value […]

Continue reading ›

Q2 2021 Passionate Investor

Q2 2021 Passionate Investor Market Review* Equity markets generally outperformed fixed-income markets with the S&P 500 rising 8.55% (including dividends; +15.25% YTD) and the Barclay’s Capital U.S. Aggregate Bond index rising 1.82% (-1.60% YTD). Small caps underperformed large-cap stocks (S&P 500) as the Russell 2000 small-cap stock index returned +5.47% (+17.54% YTD). Value outperformed growth […]

Continue reading ›Mutual Funds, ETFs or Stocks?

Are Mutual Funds Always a Better Choice Than Individual Stocks? Over the past few decades, mutual funds, along with their newer cousin, exchange-traded funds (“ETFs”), have ballooned in popularity. These financial tools provide convenience: you can diversify your investments in one fell swoop, so you are less subject to loss if any one company fails. Mutual funds can also help you buy an entire index or industry […]

Continue reading ›Q1 2021 Passionate Investor

Q1 2021 Passionate Investor Market Review Equity markets generally outperformed fixed-income markets with the S&P 500 rising 6.17% (including dividends) and the Barclay’s Capital U.S. Aggregate Bond index falling 3.37%. Small caps outperformed large-cap stocks (S&P 500) as the Russell 2000 small-cap stock index returned +12.70%. Value outperformed growth during the quarter (as determined by […]

Continue reading ›The Passionate Investor Q4 2020

Market Review Equity markets generally outperformed fixed-income markets with the S&P 500 rising 12.15% (including dividends; +18.40% YTD) and the Barclay’s Capital U.S. Aggregate Bond Index increasing 0.67% (+7.51% YTD). Small caps outperformed large-cap stocks (S&P 500) as the Russell 2000 small-cap stock index returned +31.37% (+19.86% YTD). Value outperformed Growth during the quarter but underperformed over […]

Continue reading ›

The Passionate Investor Third Quarter 2020 and the Coronavirus Impact

The Passionate Investor Third Quarter 2020 and the Coronavirus Impact Market Review Equity markets generally outperformed fixed-income markets with the S&P 500 rising 8.93% (including dividends; -5.57% YTD) and the Barclay’s Capital U.S. Aggregate Bond index increasing 0.62% (+6.79% YTD). Small caps underperformed large cap stocks (S&P 500) as the Russell 2000 small cap stock […]

Continue reading ›